The Essential Overview to Hard Money Loaning: Provider and Advantages Explained

Tough money borrowing has actually ended up being a prominent financing alternative for genuine estate capitalists seeking fast capital. This overview describes the fundamental elements of difficult cash lendings, including their unique services and advantages. It exposes how these financings operate and the scenarios in which they excel compared to conventional financing. Understanding the nuances of hard money lending could improve financial investment methods and open doors to brand-new possibilities. What advantages might wait for those who select this course?

What Is Hard Money Financing?

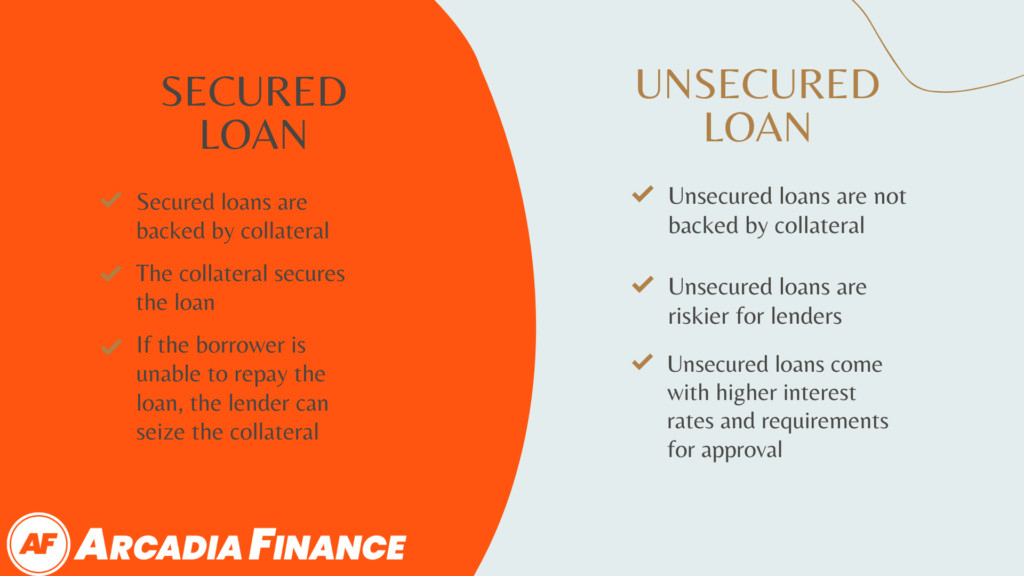

Hard money borrowing is a type of financing that counts on the value of real estate as collateral instead of the consumer's credit reliability - Hard Money Lenders Atlanta. This type of loaning is normally made use of for temporary fundings, making it appealing to genuine estate investors and designers requiring fast accessibility to capital. Difficult cash lending institutions usually consist of private people or firms that are willing to supply funds based on the building's equity, as opposed to typical financial criteria.Interest prices for difficult cash car loans often tend to be higher than conventional fundings, showing the boosted threat taken on by lenders. These lendings are usually protected by a lien versus the residential property, making sure that the lending institution can recover their investment in situation of default. Hard money borrowing can be a practical choice for those that require rapid financing and might not receive standard lendings as a result of various conditions, such as bad credit background or immediate project timelines

How Hard Cash Loaning Functions

While several standard finances depend greatly on the debtor's financial history, difficult cash offering operates mainly on the residential property's value as collateral. This type of funding is normally promoted by private financiers or firms instead than financial institutions. When a consumer approaches a difficult money lending institution with a residential property in requirement of funding, the process begins. The lender evaluates the property's market value and potential commercial, often calling for an appraisal.Once the home is analyzed, the lender figures out the finance amount, typically a portion of the property's worth, recognized as the loan-to-value proportion. Unlike standard car loans, tough cash financings are accelerated; borrowers usually obtain funds within days. Repayment terms are normally short, ranging from a few months to a couple of years. Rates of interest have a tendency to be greater due to the increased danger involved, however for those in urgent demand of resources, hard money providing deals a practical remedy.

Key Services Supplied by Hard Money Lenders

When seeking funding remedies, customers usually discover that tough money loan providers supply a series of solutions customized to fulfill their specific demands. These lending institutions mostly focus on property purchases, supplying lendings secured by the building itself. This permits faster approval procedures compared to standard financial institutions, which is vital for time-sensitive projects.Hard money lenders likewise offer adaptable terms, suiting various consumer circumstances, including those with less-than-perfect credit report or special residential property types. Additionally, lots of hard money lending institutions give swing loans, assisting borrowers shift in between financing options or secure funding for improvements prior to re-financing later.Another crucial solution includes building assessment assistance, where lenders analyze a home's worth to figure out financing amounts. Eventually, difficult cash lending institutions deal with investors and developers seeking effective and quick financing solutions, allowing them to seize chances in an open market.

Advantages of Hard Money Lending

Difficult money offering offers a number of benefits that appeal to consumers looking for fast financing services. The authorization procedure is typically faster than traditional lendings, allowing accessibility to funds when time is of the significance. Furthermore, flexible financing terms can be tailored to satisfy the certain demands of the consumer, boosting the general lending experience.

Faster Approval Process

Steering the globe of property financing commonly leads financiers to seek options that can expedite their tasks. Hard money borrowing is recognized for its expedited approval procedure, which notably contrasts with traditional financing approaches. While conventional lenders frequently require considerable documentation and lengthy analyses, difficult cash lending institutions focus mainly on the worth of the home rather than the borrower's credit reliability. This streamlined method allows investors to secure funds quickly, enabling them to maximize time-sensitive opportunities. The faster authorization procedure not just lowers waiting durations however likewise boosts an investor's capability to make affordable deals in a dynamic market. Therefore, hard money offering serves as a useful device for those seeking to accelerate their realty endeavors.

Adaptable Finance Terms

While standard lenders commonly enforce rigid terms and conditions, difficult cash lending offers a level of versatility that can be particularly helpful for genuine estate investors. This adaptability allows debtors to work out financing quantities, rates of interest, and repayment schedules customized to their particular needs. Hard money lenders focus on the worth of the collateral rather than the borrower's creditworthiness, making it easier to safeguard funding swiftly. In addition, terms can usually be changed based on the job's timeline or market problems. This versatility enables financiers to react swiftly to difficulties or possibilities, guaranteeing they find can maximize the real estate market's dynamic nature. On the whole, adaptable car loan terms give a critical advantage for those looking for to optimize their investment potential.

Comparing Hard Money Financing to Conventional Funding

When assessing funding options, one have to think about the distinct attributes of hard cash lending unlike standard funding. Tough money loans are generally safeguarded by property and are provided by personal lenders, focusing largely on the home's worth instead than the consumer's creditworthiness. This enables for quicker disbursements and approvals, making them appealing for urgent financing needs.In contrast, typical funding counts heavily on credit report, revenue confirmation, and an extra strenuous underwriting process, frequently causing longer approval times. Interest prices for difficult cash lendings have a tendency to be greater because of the boosted danger thought by loan providers. In addition, the financing term is usually short, ranging from a few months to a couple of years, whereas traditional finances usually extend as much as 30 years.Ultimately, the choice between tough money lending and typical funding depend upon the particular demands of the consumer and the seriousness of the financing required.

When to Pick Tough Money Loaning

Selecting difficult cash borrowing can be helpful in a number of scenarios, specifically when urgent financing requires develop. Financiers might also find it advantageous for home flipping chances, where quick accessibility to capital is essential. In addition, those encountering credit history challenges might turn to difficult money car loans as a feasible option to conventional funding.

Urgent Funding Needs

In circumstances where time is essential, hard cash loaning can act as a crucial option for urgent funding needs. Typical financing alternatives often involve prolonged authorization processes and extensive documents, which can postpone accessibility to necessary funds. Hard cash lending institutions, on the other hand, focus on rate and effectiveness, permitting consumers to safeguard funding promptly. This is specifically helpful in circumstances such as property purchases, where chances may emerge unexpectedly and require instant activity. Capitalists facing limited deadlines or those needing to deal with unexpected costs can find tough cash financings useful. The structured application process and minimal eligibility standards make tough money providing an effective choice for individuals or companies requiring swift monetary support to exploit on time-sensitive possibilities.

Building Turning Opportunities

Just how can hard cash providing transform residential or commercial property turning ventures? For genuine estate capitalists, difficult cash lendings give quick access to funding, allowing them to seize rewarding property turning possibilities. Unlike conventional loans, these funds are often accepted promptly, allowing capitalists to act quick in affordable markets. This speed can be necessary for safeguarding underestimated properties that require improvements. Additionally, hard cash lending institutions focus extra on the property's worth instead than the debtor's creditworthiness, making it an appealing option for those seeking to take advantage of distressed homes. By leveraging hard money financing, investors can successfully finance their jobs, complete renovations, and offer for earnings, eventually improving their possible returns in the vibrant real estate market.

Credit Score Difficulties Overcome

While traditional financing typically pivots on a customer's credit rating, difficult money lending offers a viable alternative for those encountering credit difficulties. This type of financing enables people with less-than-perfect credit backgrounds to safeguard funds based upon the value of the property, as opposed to their creditworthiness. Financiers who might have experienced bankruptcy, repossession, or other economic setbacks can access quick resources, enabling them to seize investment possibilities without prolonged approval processes. Tough money fundings usually involve higher rates of interest, yet the rate and flexibility they offer can outweigh the expenses for lots of. Those with credit report troubles might discover hard money providing an effective service to accomplish their real estate desires.

Tips for Locating the Right Hard Money Loan Provider

What elements should financiers take into consideration when searching for the appropriate hard cash lending institution? First, they ought to examine the lending institution's experience in the genuine estate market. A skilled lending institution will certainly comprehend local market dynamics and residential property types. Next off, capitalists should assess the terms used, including passion prices, loan-to-value ratios, and charges, ensuring they line up with their economic goals.Additionally, openness is crucial; lending institutions should give clear info concerning their requirements and processes. Investors ought to also look for reviews or reviews from previous customers to evaluate the lending institution's dependability and professionalism.Another vital aspect is the speed of funding, as difficult cash lendings are typically my latest blog post sought for time-sensitive opportunities. Ultimately, establishing an excellent rapport with the loan provider can facilitate smoother interaction and arrangement throughout the financing procedure. By thinking about these factors, financiers can locate a tough cash lender that meets their particular demands and boosts their investment techniques.

Often Asked Inquiries

What Sorts Of Residence Get Approved For Hard Money Loans?

Tough cash financings generally receive different residential property types, including residential homes, commercial buildings, land, and investment residential properties. Lenders examine the property's value and capacity for revenue rather than the consumer's credit reliability.

Exactly How Quickly Can I Receive Funds From a Difficult Money Loan Provider?

The rate of fund disbursement from a hard cash lender usually varies from a few days to a number of weeks. Aspects affecting this timeline consist of building examination, documents, and the loan provider's inner procedures.

Are Hard Cash Lendings Ideal for Beginners in Realty Investing?

Difficult money car loans can be ideal for newbies in real estate investing, offering fast funding and flexibility. Hard Money Lenders Atlanta. The greater interest prices and much shorter repayment terms may pose difficulties that call for careful consideration and monetary preparation.

What Takes place if I Default on a Difficult Cash Loan?

If an individual defaults on a difficult cash finance, the lender might initiate foreclosure proceedings. This can cause the loss of the residential property utilized as security, together with possible damages to the consumer's credit report.

Can I Refinance a Tough Cash Loan Later On?

Re-financing a tough money funding is feasible, typically after improving creditworthiness or boosting home worth. Consumers need to speak with lending institutions for options, as terms and eligibility may differ based upon private conditions and the loan provider's plans. Tough money lenders commonly consist of private individuals or firms that are eager to supply funds image source based on the home's equity, instead than typical banking criteria.Interest prices for tough money loans often tend to be higher than traditional fundings, showing the boosted danger taken on by lending institutions. Unlike conventional loans, tough cash finances are sped up; debtors usually obtain funds within days. Furthermore, several tough cash lending institutions provide bridge car loans, aiding customers shift between funding options or secure funding for restorations before re-financing later.Another essential solution includes property analysis support, where lending institutions examine a building's worth to establish financing quantities. Tough money lendings are commonly safeguarded by actual estate and are released by personal lending institutions, concentrating mainly on the residential or commercial property's worth rather than the customer's credit reliability. Capitalists need to likewise look for reviews or reviews from previous customers to assess the loan provider's integrity and professionalism.Another essential aspect is the rate of funding, as hard money fundings are typically sought for time-sensitive possibilities.